President Trump is facing a growing crisis on both political and economic fronts as his aggressive tariff war with China begins to implode. In what is being viewed by many as a calculated diplomatic rebuke, China announced that it is not engaged in any formal trade negotiations with the United States, contradicting repeated claims from Trump and his administration that talks were progressing.

This statement, issued through China’s Ministry of Commerce, not only exposes a lack of coordination between the two powers but leaves Trump politically vulnerable, economically cornered, and increasingly alone on the global stage.

The unraveling of Trump’s tariff strategy comes at a time of rising pressure from financial markets, business leaders, and even political allies who are beginning to question the sustainability of the current economic course.

Trump had promised that tough tariffs on Chinese goods would force Beijing to the negotiating table and protect American jobs, but the reality appears far grimmer. Not only has China refused to engage, it has begun retaliating in ways that strike at key sectors of the U.S. economy, including agriculture and retail.

One of the most symbolic acts of retaliation came when China canceled a 12,000 metric ton purchase of American pork, according to data released by the U.S. Department of Agriculture. This cancellation represents the largest such order retraction since the early days of the COVID-19 pandemic and is seen by analysts as a pointed response to Trump's most recent tariff hike.

Earlier this month, the president stunned economic observers by slapping a 145 percent tariff on Chinese imports, a dramatic escalation that pushed existing duties to levels not seen in the modern era. China responded with a 125 percent tariff of its own, bringing the effective rate on U.S. pork imports into China to an unsustainable 172 percent.

For American pork producers, the fallout has been swift and severe. China had been the third-largest destination for U.S. pork exports in 2024, trailing only Mexico and Japan.

The canceled order follows a broader trend of declining agricultural trade with China, as Beijing diversifies its partners and strengthens ties with European nations. Within days of announcing its rejection of U.S. negotiations, China signed agricultural agreements with Spain for pork and cherry imports. These deals were strategically timed and widely interpreted as China signaling its readiness to move on from the United States.

The economic implications of this standoff are becoming increasingly difficult for Trump to ignore. The S&P 500 index has dropped ten percent since the beginning of his second term, and fears of a looming recession are mounting.

Business leaders have sounded the alarm in private and public meetings, warning the administration that continued tariff pressure could empty store shelves during the upcoming holiday season. CEOs from Walmart, Target, and Home Depot met with the president on Monday to stress the risk of price surges and consumer backlash.

Trump’s approval ratings have mirrored this economic slide. Once boasting approval above 50 percent in the opening days of his new term, he now sits below 45 percent on average.

A recent Reuters/Ipsos poll placed his approval on economic matters at just 37 percent, the lowest point of his presidency. What was once considered Trump’s strongest political asset—his stewardship of the economy—has become one of his most damaging liabilities.

Despite these developments, Trump insists that negotiations with China are ongoing. Speaking to reporters outside the White House, he claimed that meetings with Chinese counterparts had occurred as recently as that morning.

“They had meetings this morning, and we’ve been meeting with China,” Trump said, dismissing media reports that talks had stalled. “I think you have your reporting wrong,” he added, suggesting details of the talks would be revealed later. However, no proof has been provided, and China has publicly rejected those assertions, calling reports of progress “groundless” and “like trying to catch the wind.”

Trump has also blamed the media for spreading false information and painting an inaccurate picture of the situation. Yet, the lack of concrete movement and mounting evidence of Chinese resistance suggests that it is the White House, not the press, that is struggling to manage the optics of this trade war.

Treasury Secretary Scott Bessent reportedly told investors earlier this week that he expects a de-escalation, but his comments, made behind closed doors, contrast sharply with Trump’s public tone, which continues to project defiance and resolve.

Experts believe China is using this moment strategically. With Trump politically weakened and facing pushback at home, Beijing may feel emboldened to resist pressure and let the economic pain unfold further.

“In this game of chicken, Trump appears to be the more likely of the two to blink,” said Owen Tedford, a senior analyst at Beacon Policy Advisors. According to Tedford, Trump has already shown a pattern of retreating when confronted with intense pressure, and this gives China more leverage in the ongoing standoff.

Another former national security aide echoed that sentiment, suggesting Trump has overplayed his hand. “He’s made threats that even now he can’t possibly maintain, and they have him a little bit over a barrel,” the aide said.

They pointed out that while China’s economy is also suffering from the tariffs, it has been more effective in shielding its key sectors and shifting its export strategy toward friendlier markets. Meanwhile, the U.S. continues to face internal turmoil and growing dissatisfaction among voters.

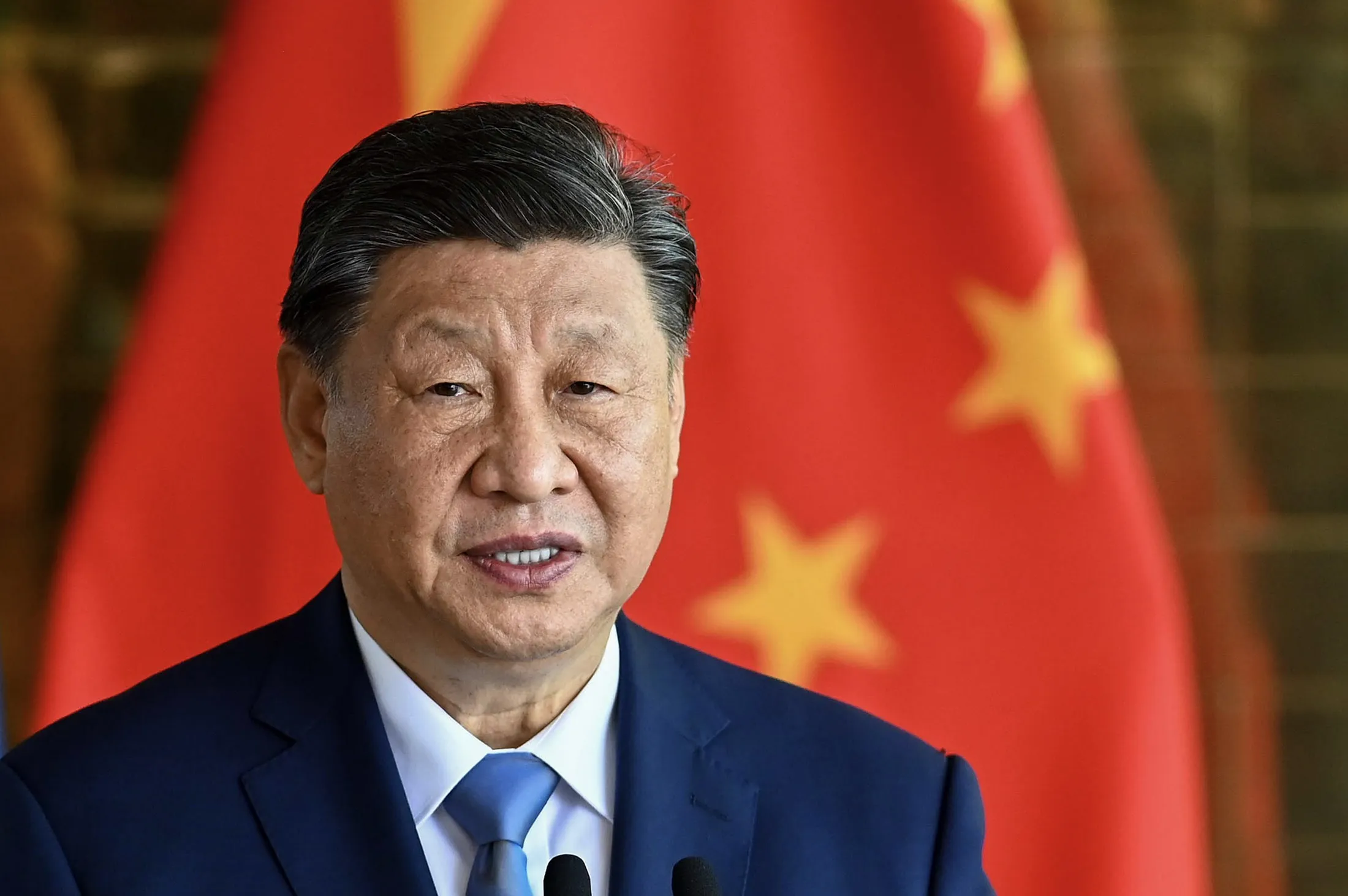

Beijing’s approach is also shaped by a desire to appear strong and unyielding. Chinese President Xi Jinping is reportedly hesitant to be seen as capitulating to American pressure, particularly when Washington is viewed as the aggressor in the trade conflict.

“Xi somehow, notwithstanding all the bad things China does, is coming out of the last week looking like a winner and a statesman,” the former aide added.

The impasse is further complicated by Trump's personal style of negotiation. He has consistently preferred high-level, leader-to-leader talks, often bypassing lower-level diplomatic channels.

But Chinese officials are seeking preliminary discussions with specific American representatives before committing to a summit. Tedford notes that a Chinese leader has not initiated direct negotiations with a U.S. president since before the 9/11 attacks, and any reversal of that precedent would be politically sensitive in Beijing.

The most likely outcome, according to multiple experts, is a forced retreat by the Trump administration under the weight of domestic economic consequences. Financial market instability, pressure from business communities, and the risk of consumer blowback are all factors that could push Trump toward reducing tariffs or agreeing to more modest terms.

Yet each day that passes without a resolution adds to the perception that China, not the U.S., is holding the upper hand.

Trump’s tough talk on China has long been a centerpiece of his economic message. But as the numbers shift and key allies express doubts, it is becoming increasingly difficult to argue that this approach is working.

What began as a high-stakes gamble to reassert American dominance in global trade is now looking more like a costly miscalculation that is eroding the very strength Trump hoped to project.

If there is an off-ramp to this crisis, it remains unclear who will take the first step. Until then, the U.S. president finds himself twisting in the wind—pressured by allies, undermined by economic indicators, contradicted by the very country he insists is cooperating, and left waiting for talks that, at least for now, China says are not happening at all.