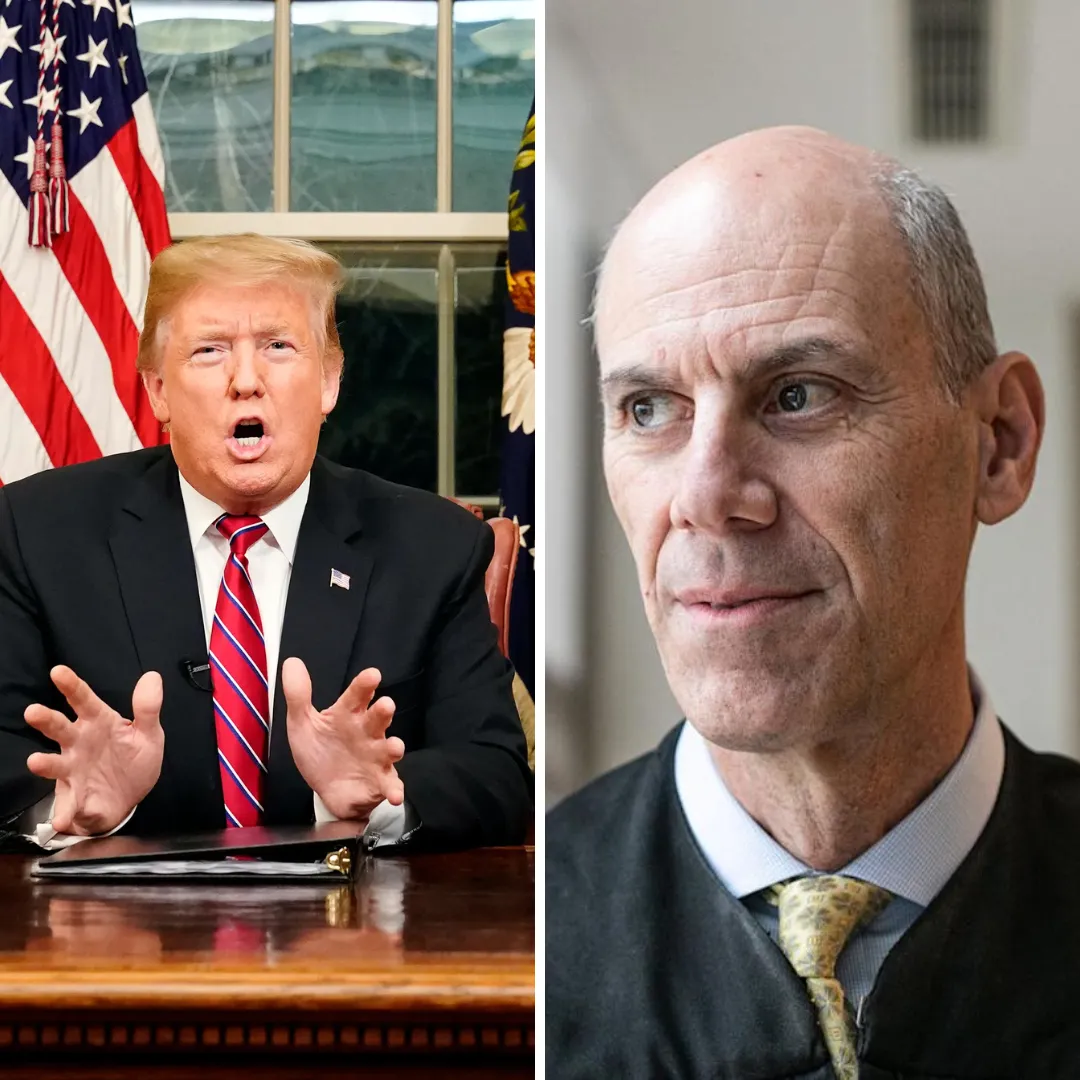

Ken Griffin, the billionaire founder and CEO of Citadel and one of the Republican Party’s most influential donors, has issued a stark warning about the current state of the U.S. economy under President Donald Trump’s second term.

Speaking at the World Economy Summit, Griffin sharply criticized the administration’s latest round of sweeping tariffs, arguing that the value of the U.S. dollar has taken a dramatic hit, weakening the country’s global standing and eroding its economic resilience.

In a candid conversation with moderator Gina Chon, Griffin laid out his concerns in direct terms, claiming that recent policies had inflicted swift and serious damage.

"The country has become 20 percent poorer in four weeks," Griffin said. "We put that brand at risk. It can be a lifetime to repair the damage that has been done."

Since the start of the year, the U.S. dollar index has dropped more than 9 percent, according to financial data reviewed during the summit. This decline in the currency’s strength has alarmed economists and investors, who view a strong dollar as a vital indicator of economic stability, purchasing power, and global influence.

Griffin attributed the drop in part to Trump’s combative trade stance, including a recently announced baseline tariff of 10 percent on nearly all foreign imports, along with steep reciprocal tariffs aimed at key trade partners such as Canada, Mexico, and European Union member states.

While the administration granted a temporary three-month exemption for some of the retaliatory duties, excluding China, the initial impact has already reverberated through markets and international relations.

The hedge fund titan was unsparing in his criticism of the president’s economic playbook, suggesting that the current strategy was not only ineffective but dangerously shortsighted.

"I’ll tell you what’s not going to happen is, people are not going to raise money to build manufacturing in America," Griffin said. "Because with the policy volatility, you actually undermine the very goal you’re trying to achieve."

Griffin’s remarks are among the most blunt assessments yet from a high-profile financial figure with ties to the Republican establishment. While he has previously supported Trump and GOP economic policies, his statements at the summit made clear he sees the current path as unsustainable.

Echoing the warnings of other economists and global leaders, Griffin said the new tariff regime creates a scenario with no real winners. Instead of spurring a manufacturing revival or reshoring supply chains, the tariffs have forced countries and companies alike into a defensive position.

"Everyone is just trying to tread water and not drown," he said.

Of particular concern to Griffin and other industry leaders is the impact on sectors like automotive manufacturing, construction, and beverage production — industries that rely heavily on steel and aluminum imports.

The sudden price spikes caused by tariffs have thrown budgets into disarray, disrupted supply chains, and made future investment in U.S.-based manufacturing less attractive.

Griffin questioned the long-term diplomatic fallout as well, suggesting that the administration’s unilateral actions risk alienating traditional allies and weakening the network of relationships that has long underpinned American economic and geopolitical strength.

"How does Canada feel about our country today versus two months ago? How does Europe feel about the United States today versus two months ago?" he asked.

The rhetorical questions highlighted the broader implications of Trump’s policies, which critics say ignore the importance of maintaining stable and cooperative international relationships. Griffin pushed back against the idea that these relationships are expendable or irrelevant.

"And some people scream, ‘Well, it just doesn’t matter.’ But you know what? It matters for a very profound reason," he said. "The entire Western world is engulfed in a debt crisis."

Griffin’s remarks come at a precarious moment for the global economy. While U.S. economic data remains mixed — with some indicators showing resilience and others signaling contraction — concerns are rising that the current trajectory may lead to recession within the next year.

Inflation remains a pressure point, and the combination of tighter financial conditions, increased costs from tariffs, and an increasingly hostile trade environment could tip the balance.

Trump’s recent public spat with Federal Reserve Chair Jerome Powell has added further volatility to the mix. The president’s latest attacks on Powell have raised eyebrows among financial professionals, many of whom see them as attempts to politicize the central bank and undermine its independence.

These actions have shaken investor confidence and raised fears about the future of monetary policy in the United States. Griffin did not hold back in expressing concern over what he described as reckless behavior that threatens the credibility of the U.S. financial system.

"There’s a trust that underpins the value of the dollar, of our markets, of our institutions," he said. "You start chipping away at that, and pretty soon you’re left with something that doesn’t inspire trust — and without trust, markets don’t work."

The erosion of that trust has already begun to manifest in currency markets and investor sentiment. The dollar’s decline, while offering some short-term benefits to exporters, has broader consequences for American consumers and businesses.

Imported goods become more expensive, purchasing power is reduced, and inflationary pressures can build. For companies with international operations, currency losses can eat into profits and complicate financial planning.

Griffin’s warning is particularly significant given his long-standing role as a GOP donor and financial influencer. While he stopped short of calling for a change in leadership or endorsing specific policy alternatives, his message was unmistakable. He believes the administration’s current course is economically unsound and politically damaging.

Observers noted that Griffin’s remarks could signal a shift in the donor class’s attitude toward Trump’s economic leadership. With elections on the horizon and Republican candidates jockeying for position, criticism from figures like Griffin may embolden others to speak out or seek alternative visions for the party’s economic strategy.

Even among Republicans who support the administration’s general aims, there is growing discomfort with the execution. The promise of reinvigorated American industry has yet to materialize in meaningful ways, and the costs of the trade war — both financial and diplomatic — are beginning to mount.

Meanwhile, businesses continue to adjust to the unpredictable terrain. Some are shelving investment plans, others are looking to relocate operations to countries less affected by U.S. tariffs. In boardrooms and factories alike, uncertainty reigns.

For workers, the picture is no clearer. While employment remains strong in some sectors, others face layoffs, wage stagnation, or rising costs that eat into household budgets. The rising price of materials, especially metals, has ripple effects across industries, affecting everyone from auto workers to construction crews to warehouse employees.

Griffin’s comments also underscore a larger concern among economists about the long-term health of the American economy. With federal debt levels rising, interest rates climbing, and inflation still a threat, the U.S. may be entering a period of reduced fiscal and monetary flexibility.

That environment makes it all the more important for economic policies to be consistent, credible, and grounded in long-term strategy. Instead, critics argue that Trump’s approach has been driven by political theatrics and short-term gains. The tariff hikes, they say, are emblematic of a deeper problem: a lack of coherent policy anchored in economic fundamentals.

Despite the controversy, Trump has remained steadfast in defending his trade agenda, often pointing to past trade imbalances and arguing that tariffs are a necessary tool to level the playing field. He has dismissed concerns about the dollar’s decline and downplayed the risks of economic retaliation from other nations.

Whether that narrative continues to resonate with voters and markets remains to be seen. For now, voices like Ken Griffin’s are raising alarms, offering a counterpoint to the administration’s confidence and urging a course correction before the economic damage becomes irreversible.